2026 Compliance Readiness: How AI Is Helping UAE…

As businesses step into 2026, one thing is clear: compliance is no longer just a back-office…

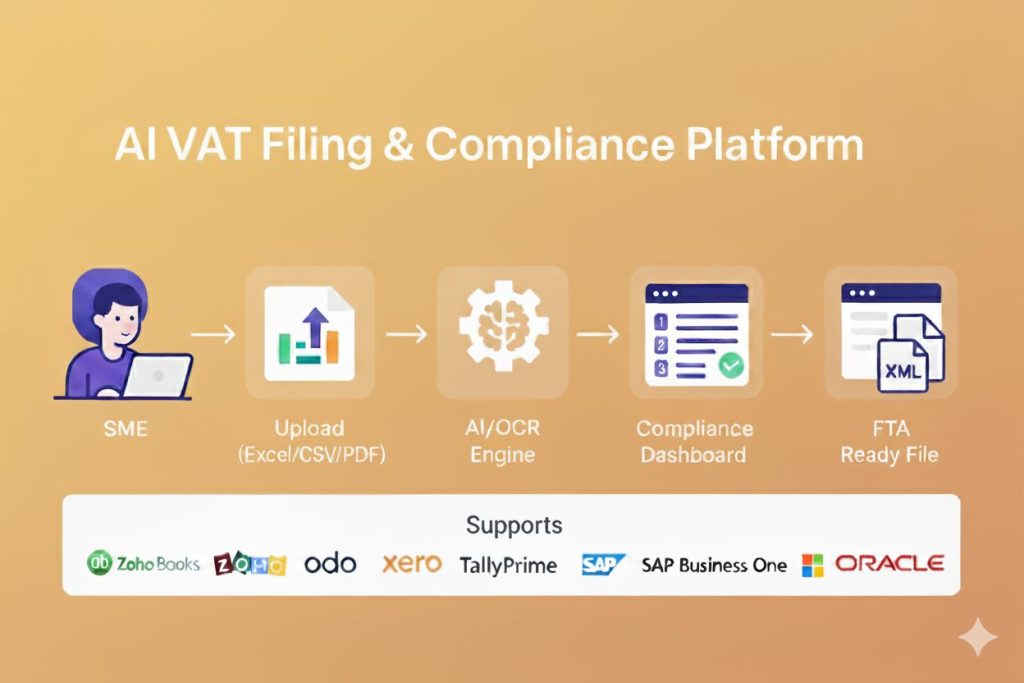

FinRubah automates your VAT return preparation. Upload your invoices, and our AI engine will categorize, validate, and generate your FTA-ready file instantly.

VAT Returns in Minutes. No Spreadsheets. No Mistakes.

Automated VAT Compliance Built for UAE SMEs.

Never Miss a VAT Filing Deadline Again.

Automate VAT filing with AI, eliminating spreadsheet errors and manual calculations.

Stay always FTA-compliant with real-time updates, reminders, and audit-ready records.

VAT filing is tedious and error-prone, requiring manual checks on sales, purchases, and tax rates.

Staying compliant with FTA rules is difficult, leading to missed deadlines and audit risks.

FinRubah helps enterprises automate e-invoicing, VAT filing, and compliance with AI-driven accuracy — reducing manual work, ensuring regulatory readiness, and unlocking business efficiency.

At FinRubah, we’re redefining how businesses handle their financial and compliance operations. Our AI-powered platform simplifies VAT filing, UAE mandatory E-invoicing, and automates complex financial workflows, enabling enterprises to stay compliant, efficient, and audit-ready.

From intelligent VAT automation to real-time reporting and analytics, FinRubah helps organizations reduce manual effort, eliminate errors, and focus on strategic growth. Every solution we build aligns with UAE’s FTA regulations, ensuring your business remains compliant today — and future-proof for tomorrow’s digital tax ecosystem.

FinRubah’s AI-driven VAT automation platform simplifies tax compliance from end to end.

Upload invoices in any format — Excel, PDF, or ERP export — and let AI handle the rest. Our system automatically extracts key data, classifies taxable transactions, calculates VAT liability, and generates FTA-ready return files. No spreadsheets, no manual errors — just smart, compliant filing every time.

Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for ‘lorem ipsum’ will uncover many web sites still in their infancy.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar.

Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for ‘lorem ipsum’ will uncover many web sites still in their infancy.

Automation: Less manual work; more accuracy.

Compliance first: Built to FTA rules; regulatory changes handled.

Localised UX: Arabic + English; fees & invoices in AED; TRNs; UAE entity rules.

Audit readiness: Full logs, version history, corrections.

Compatible ERPs: Compatible with leading accounting and ERP systems, including Zoho Books, QuickBooks, Odoo, Xero, TallyPrime, SAP Business One, and Microsoft Dynamics 365 — with simple Excel/CSV import support for all other platforms.

Luctus nec ullamcorper mattis pulvinar.

Luctus nec ullamcorper mattis pulvinar.

Luctus nec ullamcorper mattis pulvinar.

Find quick answers to the most common questions about FinRubah and how it helps your business.

Excel, CSV, or PDF — upload individually or in bulk. The system auto-extracts and validates all data.

No problem. The system flags errors, and you can easily review and edit before generating your VAT return.

We prepare your FTA-ready VAT file (Excel/XML) for direct upload. Direct filing via API is coming soon.

Yes. Our tax engine auto-updates whenever FTA rules or formats change — no manual action needed.

All data is encrypted and stored on secure UAE-based cloud servers with access controls, audit logs, and regular backups.

Explore insights, tips, and updates on e-invoicing, compliance, and financial automation to help your business grow smarter.

As businesses step into 2026, one thing is clear: compliance is no longer just a back-office…

The UAE Ministry of Finance has announced major changes to the Value Added Tax (VAT) filing…

For many Small and Medium Enterprises (SMEs) in the UAE, Value Added Tax (VAT) compliance is…

Fill out the form below and our team will connect with you shortly.